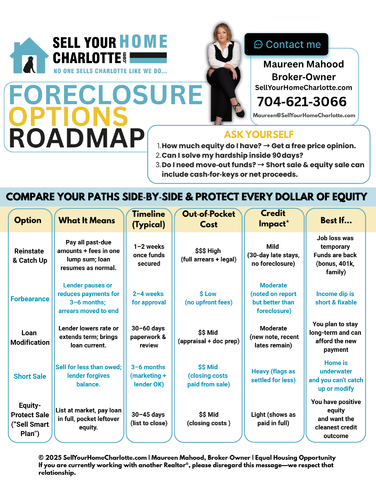

If you’re searching for foreclosure help in Charlotte, NC, you still have options. North Carolina lenders must wait 45 days after a “breach” letter and at least 120 days of missed payments before a foreclosure hearing can even be scheduled. Use that breathing room to choose the best path forward.

Table of Contents

- Reinstate the Loan

- Modify the Loan

- Sell Smart

- Free “Stay‑in‑Control” Toolkit

- 10‑Question FAQ

- Next Steps

Reinstate the Loan: Catch Up & Move On

Stops foreclosure instantly. Wire the past‑due amount plus late fees and the case disappears.

- No extra paperwork. Your rate and term stay the same.

- You keep every dollar of equity.

Quick Tip: Skip the main menu—call your servicer’s loss‑mitigation line and ask for a written reinstatement quote with a deadline. If the lump sum feels impossible, jump to Option 2 or dial the free State Home Foreclosure Prevention Project at 888‑442‑8188.

Modify the Loan: Lower or Stretch the Payment

A loan mod can roll missed payments to the back of the loan, drop your rate, or extend the term.

- Lenders prefer mods over auctions—it costs them less.

- Paperwork is simple: hardship letter, pay stubs, bank statements, last tax return, and a budget proving the new payment works.

Heads‑Up: Send a complete package; missing docs reset the 30‑day review clock. Park any “trial” payments in a separate account until you get written approval.

Sell Smart: Cash Out on Your Timeline

When keeping the house no longer fits your life or budget, listing before the courthouse auction lets you:

- Protect credit. A standard sale reports paid‑off, not foreclosed.

- Pick your closing date. Need 60 days to move? Add it to the contract.

- Walk away with cash. Charlotte prices remain up year‑over‑year, so most sellers leave with money in hand—even after clearing arrears.

How I Deliver Fast, Top‑Dollar Sales

Guide | Why It Matters |

|---|---|

72‑Hour Prep Mini‑Guide | Declutter, patch, and stage in three days for scroll‑stopping photos. |

Sell Fast vs. Short Sale Net Sheet | Plug in value, payoff, and arrears—see which path leaves more cash with you. |

15‑Point Sell‑Smart Plan | Step‑by‑step marketing that drives offers under a deadline. |

30‑Day Action Plan | Daily checklist to stay ahead of bank timelines. |

How to Spot Foreclosure‑Rescue Scams | Five red‑flag phrases that scream “walk away.” |

FAQs

# | Question | Quick Answer |

1 | How long after an auction notice can I reinstate? | Up to 5 p.m. the day before the sale; the notice must post 20 days and publish 2 weeks. |

2 | What is the 10‑day upset‑bid period? | Anyone may out‑bid the buyer within 10 days, which can buy you more time to reinstate or sell. |

3 | Will I owe the bank if the sale price is short? | Possibly—NC allows deficiency judgments, but listing early usually avoids them. |

4 | Can I stay during a mod review? | Yes, once the lender marks your package “complete,” foreclosure is paused. |

5 | How do I spot a foreclosure‑rescue scam? | Up‑front fees, deed transfers, or “guaranteed” stops are red flags—call HUD first. |

6 | What docs do lenders need for a mod? | Hardship letter, pay stubs, bank statements, tax return, and a realistic budget. |

7 | Short sale vs. equity sale—difference? | Short sale nets less than payoff and needs bank OK; equity sale closes like any listing. |

8 | When does a deed‑in‑lieu make sense? | Little/no equity and failed mod or short‑sale attempts. |

9 | Can bankruptcy stop foreclosure? | Chapter 13 triggers an automatic stay but requires on‑time future payments. |

10 | Who offers free help right now? | HUD‑approved counselors & the NC State Home Foreclosure Prevention Project (888‑442‑8188). |