Buying in a due-diligence state like North Carolina means you’re paying a non-refundable fee up front. Miss a big-ticket issue and you could forfeit that money and inherit a five-figure repair. Use this guide (and your inspector’s report) to stay in the driver’s seat.

Roof Damage or Deterioration

A full roof replacement in NC averages $6,700 – $25,000 depending on size and shingle type. Inch Calculator

What to look for

- Missing / curled shingles

- Sagging decking or soft spots in the attic

- Granules in gutters after a storm

Buyer play – Ask the seller for a licensed roofer evaluation and replacement credit or a new-roof escrow.

Foundation Cracks & Settlement

Typical repairs now range $2,200 – $8,100—severe fixes can hit $30K. This Old House

Watch for

- “Stair-step” cracks in brick

- Doors that stick, sloping floors

- Gaps where walls meet ceilings

Buyer play – Bring in a structural engineer during due diligence; negotiate a price reduction instead of DIY fixes.

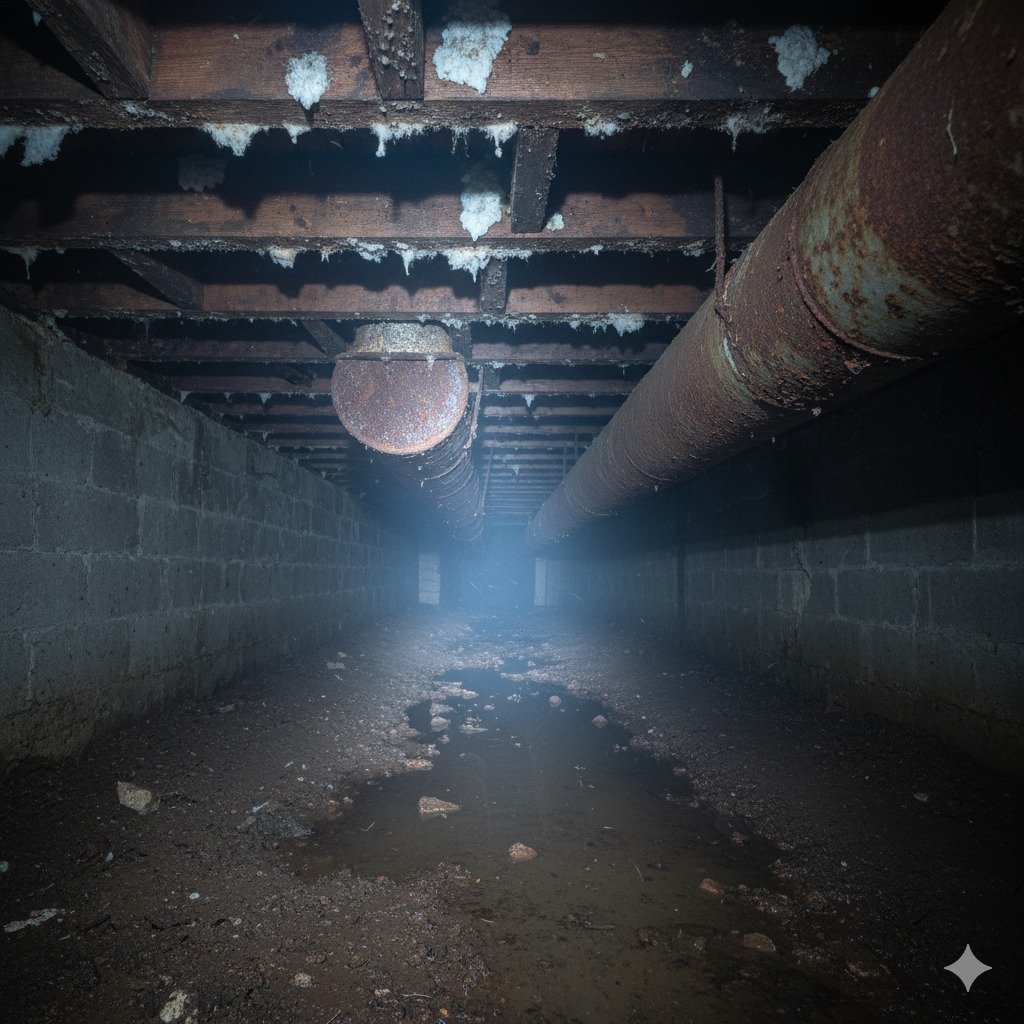

Crawl-Space Moisture & Mold

When humidity tops 60 %, wood rot and mold explode in NC crawl-spaces. Tar Heel Basement Systems

Warning signs

- Standing water or mud

- Musty odor, white fungal growth on joists

- Rusted HVAC trunk lines

Buyer play – Request vapor-barrier installation or full encapsulation credit ($1.5K–$15K, depending on size).

Termite or Other Wood-Destroying Insects

Termites cause billions in damage nationwide and stay active year-round in NC’s mild climate. Carolina Pest

Look for

- Pencil-thin mud tubes on foundations

- Hollow-sounding or blistered wood

- Discarded wings near windowsills

Buyer play – Make the contract contingent on a clear WDI letter or seller-paid treatment plan.

Polybutylene Plumbing (or Other Problem Lines)

Many NC insurers won’t cover homes with original polybutylene supply lines. Tim Clarke Real Estate

Clues

- Gray ½ʺ or ¾ʺ piping stamped “PB 2110”

- Frequent pin-hole leaks, low pressure

- Homes built 1978-1995

Buyer play – Full repipe runs $4K–$15K; push for a seller credit or adjust your offer accordingly.

Unsafe Electrical Panels & Overloaded Circuits

Federal-Pacific and Zinsco panels fail to trip reliably and are often uninsurable. Harry Levine Insurance

Tell-tales

- Panel brand: “FPE,” “Stab-Lok,” or “Zinsco”

- Warm breakers, burn marks, buzzing sounds

- Aluminum branch wiring (1965-73 builds)

Buyer play – A new 200-amp panel plus rewiring can top $2K–$7K; ask the seller to swap it before closing.

End-of-Life HVAC Equipment

Heat-pumps in humid NC lose efficiency after 10-15 years; replacements average $6K–$10K. HVAC.com

Check

- Manufacture date on data plate

- Rusted drain pans, oil streaks, low refrigerant

- Uneven temps between rooms

Buyer play – Negotiate a home-warranty and a closing credit toward new equipment.

Watch the full guide below!

What to Do When a Red Flag Pops Up

- Get specialist quotes during due-diligence—structural engineer, roofer, electrician, etc.

- Re-price the home or request seller repairs/credits using those quotes.

- Walk away if repair costs > 10 % of purchase price and the seller won’t budge. Your due-diligence fee is cheaper than inheriting a money pit.

Next-Step Resources

- Free Download: Inspection Red-Flag Infographic

- Related Post: Save Up a Down Payment in Charlotte

- Neighborhood Guide: Where First-Time Buyers Can Still Afford a Home in Charlotte (Summer 2025)

Ready to Play It Safe?

Book a 15-minute inspection-prep call. We’ll:

- Review your report line-by-line

- Price out repairs with trusted pros

- Draft a bullet-proof negotiation strategy

Your first home shouldn’t start with a five-figure surprise—let’s make sure it doesn’t.